New Direction Trust Company is revolutionizing the way individuals approach their retirement savings through self-directed retirement accounts. This innovative company empowers investors by allowing them to take control of their financial futures, offering a wide range of investment options beyond traditional stocks and bonds. In this article, we will explore what New Direction Trust Company offers, how it operates, and why it might be the right choice for your retirement planning.

Retirement planning can be daunting, especially with the myriad of options available. Understanding the ins and outs of self-directed accounts can make a significant difference in your financial future. New Direction Trust Company specializes in providing the tools and resources necessary for investors to diversify their portfolios, reduce fees, and achieve their retirement goals.

In the following sections, we will delve deeper into the services provided by New Direction Trust Company, the benefits of self-directed retirement accounts, and tips for making the most of your investments. Let's get started!

Table of Contents

- Overview of New Direction Trust Company

- Services Offered

- Benefits of Self-Directed Retirement Accounts

- How to Open an Account

- Investment Options Available

- Understanding Fees

- Customer Support and Resources

- Conclusion

Overview of New Direction Trust Company

Founded in 2003, New Direction Trust Company has established itself as a leader in the self-directed retirement account industry. The company is based in Colorado and is known for its commitment to helping investors achieve financial independence through education and personalized support.

As a custodian for self-directed IRAs, New Direction Trust Company allows clients to hold a wide variety of assets in their retirement accounts, including real estate, private equity, and more. This flexibility enables investors to create diversified portfolios tailored to their individual risk tolerance and investment goals.

Company Mission and Values

New Direction Trust Company is dedicated to empowering clients by providing transparent, efficient, and comprehensive custodial services. Their core values include:

- Client Education

- Integrity and Transparency

- Innovation and Adaptability

- Exceptional Customer Service

Services Offered

New Direction Trust Company provides a range of services designed to enhance the self-directed investment experience. These services include:

- Self-Directed IRA Custodial Services

- Real Estate Investment Support

- Private Placement Investments

- Cryptocurrency Custody

- Education and Resources for Investors

Self-Directed IRA Custodial Services

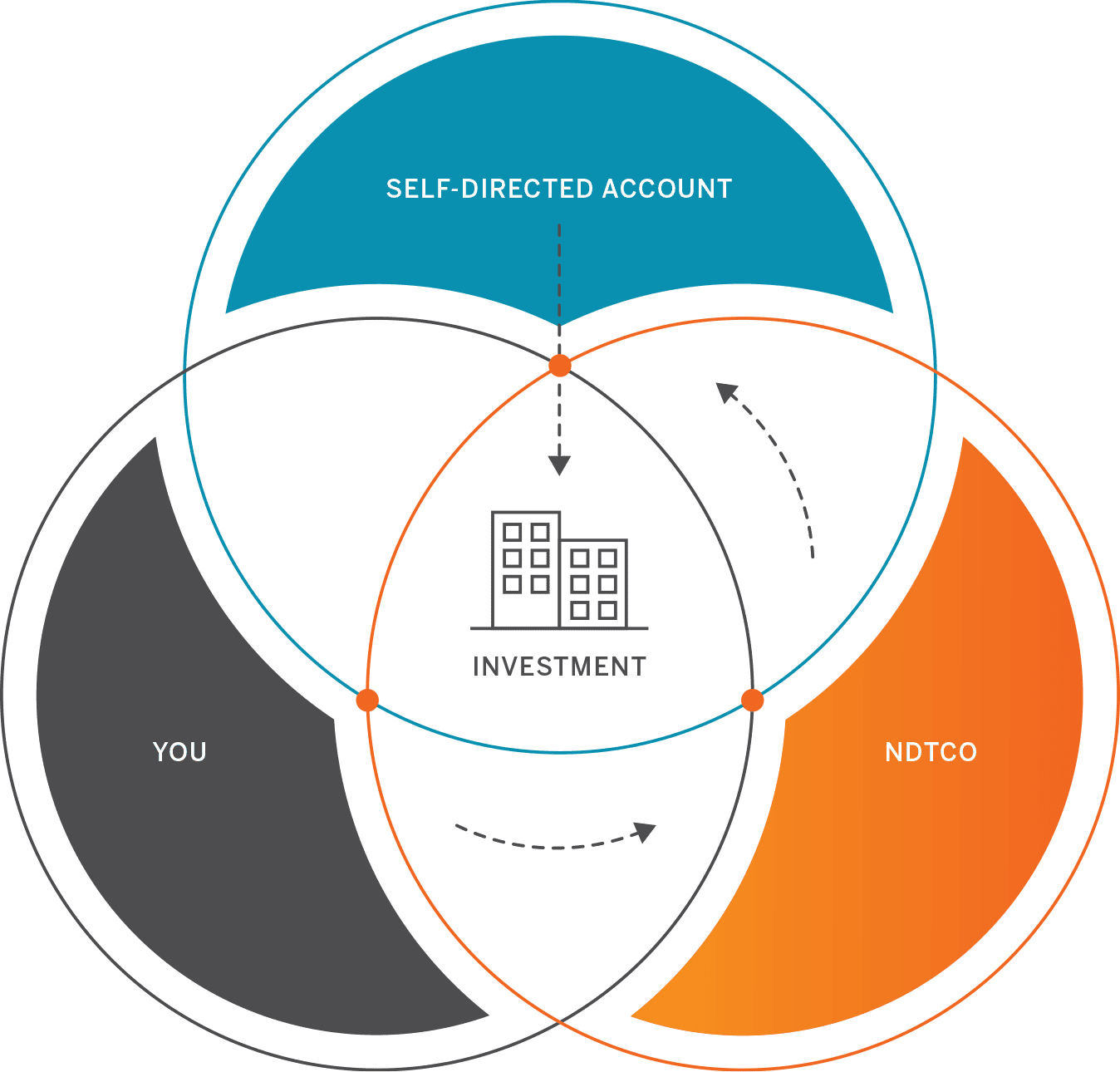

New Direction Trust Company specializes in self-directed IRA custodial services, allowing clients to invest in a diverse array of assets. This service includes account setup, administration, and compliance support, ensuring that clients meet IRS regulations while enjoying the benefits of self-directed investing.

Real Estate Investment Support

Investing in real estate can be a lucrative option for retirement savings. New Direction Trust Company offers guidance and support throughout the entire process, from identifying potential properties to managing transactions and ensuring compliance with IRS regulations.

Benefits of Self-Directed Retirement Accounts

Self-directed retirement accounts offer several key benefits that can significantly enhance your investment strategy:

- Greater Control: Investors have the authority to choose their investments, allowing for more personalized strategies.

- Diverse Investment Options: Self-directed accounts enable investments in a wide range of assets, including real estate, private loans, and cryptocurrencies.

- Potential for Higher Returns: By diversifying beyond traditional investments, clients may achieve higher returns on their retirement savings.

- Tax Advantages: Self-directed IRAs and other retirement accounts offer tax-deferred growth, allowing investments to compound without immediate tax implications.

How to Open an Account

Opening an account with New Direction Trust Company is a straightforward process. Here are the steps to get started:

- Choose the Type of Account: Decide whether you want a self-directed IRA, solo 401(k), or another retirement account.

- Complete the Application: Fill out the online application form available on the New Direction Trust Company website.

- Fund Your Account: Transfer funds from an existing retirement account or make a new contribution to fund your self-directed account.

- Select Your Investments: Start researching and selecting your investment options.

Investment Options Available

New Direction Trust Company offers a wide array of investment options to suit various investor preferences:

- Real Estate

- Precious Metals

- Private Equity

- Cryptocurrency

- Notes and Loans

Real Estate Investments

Real estate is one of the most popular investment choices for self-directed IRAs. Investors can purchase residential, commercial, or raw land as part of their retirement strategy.

Cryptocurrency Investments

New Direction Trust Company also allows clients to invest in cryptocurrencies, providing a modern investment avenue that can enhance portfolio diversification.

Understanding Fees

It is essential to understand the fee structure associated with self-directed accounts at New Direction Trust Company. The main fees include:

- Account Setup Fee

- Annual Maintenance Fee

- Transaction Fees for Investments

Be sure to review the fee schedule carefully, as these costs can impact your overall investment returns.

Customer Support and Resources

New Direction Trust Company prides itself on providing exceptional customer support. Their team of knowledgeable professionals is available to assist clients with any questions or concerns related to their accounts.

Additionally, the company offers a wealth of educational resources, including webinars, articles, and guides, to help investors make informed decisions.

Conclusion

New Direction Trust Company stands out as a premier option for individuals seeking to take control of their retirement savings through self-directed accounts. With a wide array of investment options, personalized support, and a commitment to client education, it provides the tools necessary for investors to achieve their financial goals.

If you're considering a self-directed retirement account, we encourage you to explore New Direction Trust Company further. Share your thoughts in the comments below, or check out our other articles for more insights on retirement planning and investment strategies!

Final Thoughts

In the ever-evolving landscape of retirement investing, choosing the right custodian is crucial. New Direction Trust Company offers a unique opportunity for individuals to diversify their portfolios and enhance their financial futures. We hope this article has provided you with valuable insights into self-directed investing and the benefits of partnering with New Direction Trust Company. We invite you to return to our site for more informative content!